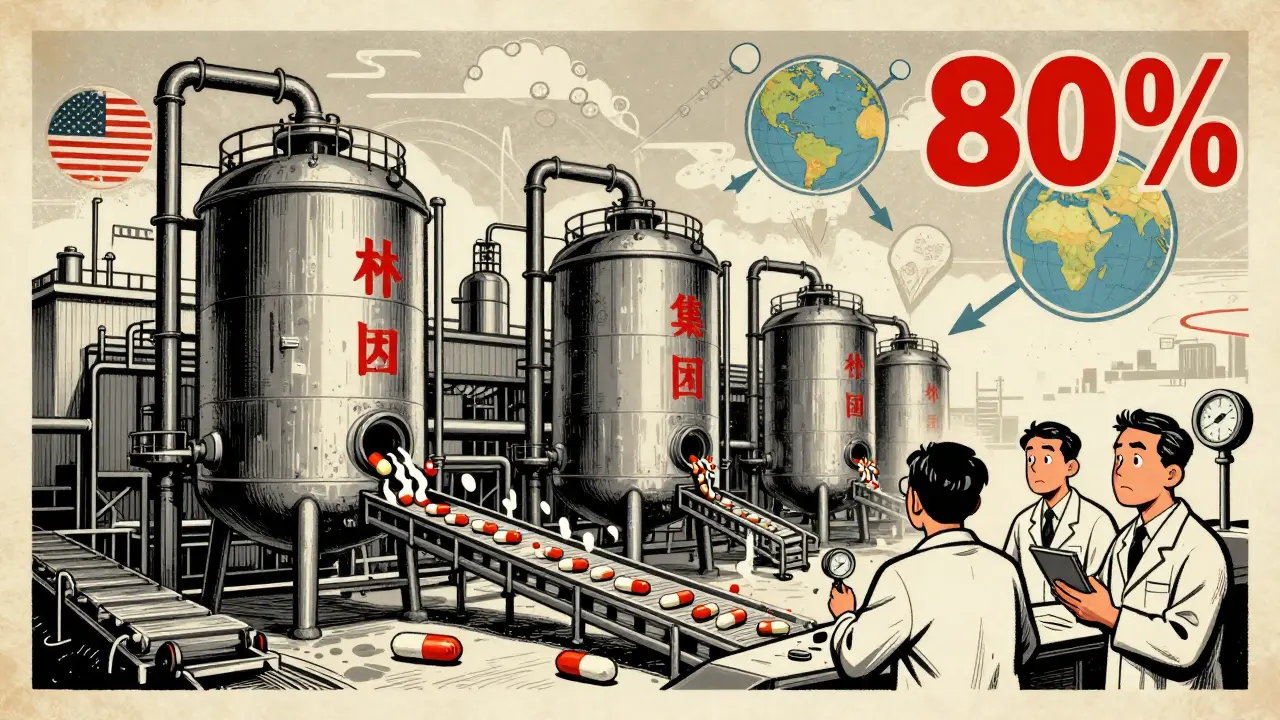

When you take a pill for high blood pressure, diabetes, or an infection, there’s a good chance the active ingredient inside came from a factory in China. In fact, Chinese manufacturers produce about 80% of the world’s active pharmaceutical ingredients (APIs) - the raw chemical building blocks that make generic drugs work. But behind the low prices and massive output lies a growing tension: can you trust the quality of drugs made in China when so much of the world depends on them?

Why China Dominates Generic Drug Production

China didn’t become the world’s top API producer by accident. After joining the World Trade Organization in 2001, the government poured billions into building chemical plants, training engineers, and offering tax breaks to pharmaceutical firms. By 2023, China was turning out over $67 billion in pharmaceutical exports - nearly 60% of that from APIs. Companies like Sinopharm, Shijiazhuang Pharma Group, and Huahai Pharmaceutical operate massive facilities that can produce 500 to 2,000 metric tons of a single API per year. That scale means they can sell APIs for $50-$150 per kilogram, while Western producers struggle to break even below $200. The secret isn’t just size - it’s control. Chinese firms own most of the supply chain. They make their own key starting materials (KSMs), handle dangerous chemical steps like fluorination, and avoid costly environmental regulations that slow down production elsewhere. This vertical integration gives them a 30-40% cost advantage. For drugmakers in the U.S. and Europe, it’s hard to say no when a batch of metformin or amoxicillin API costs half as much.The Quality Gap Nobody Wants to Talk About

Cost savings don’t always mean safe drugs. The U.S. Food and Drug Administration (FDA) has issued warning letters to Chinese API facilities for years - and the reasons are always the same. In inspections from 2022 to 2023, 78% of facilities failed on laboratory controls. That means they didn’t properly test samples or lost data. Sixty-five percent didn’t validate their manufacturing processes. And over half had data integrity issues - records altered, results deleted, or tests never run. A 2023 FDA study found that 12.7% of Chinese API samples failed purity tests. Compare that to 2.3% from Europe and 1.8% from the U.S. That’s not a small difference - it’s a red flag. In 2023, Zydus Pharmaceuticals recalled 1.2 million bottles of blood pressure medication because the API from Huahai Pharmaceutical was too weak. Patients weren’t getting the right dose. That’s not a hypothetical risk - it’s happened. Even worse, many Chinese plants still rely on outdated batch processing. While U.S. and European factories are shifting to continuous manufacturing - a smoother, more controlled method - 65% of Chinese API production still uses old-school batch methods. That increases the chance of contamination or inconsistent potency.China’s Efforts to Fix the Problem - And Why They’re Falling Short

China knows the world is watching. In 2016, the National Medical Products Administration (NMPA) launched the Generic Consistency Evaluation (GCE) program. It required Chinese generic drugs to prove they worked the same as the original branded versions. The goal was to clean up the industry. So far, only 35% of approved generics have completed the evaluation. That means two-thirds of the drugs sold in China as “equivalent” have never been properly tested for bioequivalence. The NMPA has shut down 4,500 non-compliant factories since 2018. That sounds impressive - until you realize China started with 7,000 manufacturers. That leaves 2,500. Many of those still operate under lower standards than the FDA or EMA. For example, Chinese GMP rules require less frequent environmental monitoring and shorter data retention periods. Western companies trying to source from China often spend 18 to 24 months just getting their quality systems aligned. Some Chinese officials claim progress. Dr. Liangping Liu of China’s National Institute for Food and Drug Control says 95% of GMP-certified plants now follow ICH Q7 guidelines. But certifications don’t always match reality. A 2024 survey by PhRMA found that 68% of U.S. generic drugmakers reported quality issues with Chinese-sourced APIs. Forty-two percent cited inconsistent purity. Thirty-seven percent said documentation was falsified.

14 Comments

Dwayne hiersDecember 15, 2025 AT 12:48

The data on API quality discrepancies is staggering. FDA inspections show 78% of Chinese facilities fail on lab controls, and 12.7% of samples fail purity tests-compared to under 2.5% from EU and US sources. This isn’t a ‘risk,’ it’s a systemic compliance failure. The GMP standards are fundamentally misaligned, and the cost arbitrage is being paid for in patient safety margins. Continuous manufacturing adoption in China is under 35%, while the West is pushing toward closed-system, real-time release testing. We’re not just outsourcing production-we’re outsourcing risk.

Rulich PretoriusDecember 15, 2025 AT 20:14

It’s easy to blame China, but the real failure is in our own regulatory complacency. We outsourced the backbone of our medicine supply chain because it was cheaper, then pretended the quality would self-correct. The FDA inspects Chinese plants at one-tenth the rate of domestic ones. That’s not oversight-it’s negligence dressed up as efficiency. We built a house on sand and now we’re surprised the tide came in.

Thomas AndersonDecember 16, 2025 AT 16:57

Look, I get the cost thing. But if your blood pressure med doesn’t work because the API was under-dosed, no amount of savings matters. I’ve seen labs reject 37% of Chinese metformin batches. That’s not a glitch-it’s a pattern. We need independent third-party testing, not just paperwork from the factory.

Sarthak JainDecember 18, 2025 AT 04:26

as a guy from india, i can tell u we’re just middlemen here. 65% of our apis come from china. so when u buy ‘made in india’ pills, u’re still buying china’s chemistry. we’re stuck in this web too. the indian govt knows this but can’t afford to cut ties. it’s not about trust-it’s about survival.

Edward StevensDecember 19, 2025 AT 21:40

So let me get this straight-we’re all freaking out because China makes cheap drugs… but we still buy them? Shocking. Next you’ll tell me people still eat fast food even though it’s full of chemicals. Maybe the real issue is that we’re addicted to cheap medicine and refuse to pay for quality. Welcome to capitalism, folks.

Alexis WrightDecember 21, 2025 AT 13:20

Let’s be brutally honest: China doesn’t care if you die. They’ve built an empire on regulatory arbitrage, data falsification, and environmental destruction-all while the West sits back and buys their poison at 50% off. This isn’t globalization. It’s surrender. And the FDA? They’re not regulators-they’re cheerleaders for a corrupt supply chain. If you’re on a Chinese-sourced drug, you’re basically playing Russian roulette with your organs.

Rich RobertsonDecember 22, 2025 AT 05:27

China’s rise in pharma isn’t magic-it’s strategy. They invested in infrastructure, trained engineers, and played the long game while the West outsourced and downsized. Now we’re shocked they’re good at it? We gave them the blueprint. The question isn’t whether they’re cutting corners-it’s whether we’re willing to pay the price for our own short-term thinking. The solution isn’t isolation-it’s rebuilding our capacity with accountability, not just tariffs.

Tim BartikDecember 23, 2025 AT 10:15

china is literally poisoning our medicine and we’re still buying it like it’s a black friday sale. we need to bomb their factories and bring production home. this isn’t trade-it’s treason. why are we letting a communist regime control our heart meds? #AmericaFirst #NoMoreChineseDrugs

Natalie KoeberDecember 24, 2025 AT 03:35

did you know the chinese government uses the api factories to track our blood chemistry? they’re collecting data on millions of us through our meds. that’s why they won’t let anyone audit properly. it’s not about quality-it’s about bioweapons. the FDA knows. they’re just silent. wake up.

Wade MercerDecember 24, 2025 AT 14:37

If you’re okay with taking pills from a country that falsifies test results, you’re not just irresponsible-you’re complicit. Every time you choose the cheaper option, you’re saying someone else’s life is worth less. That’s not a cost-saving strategy. That’s moral decay dressed in corporate jargon.

Jonny MoranDecember 26, 2025 AT 10:37

I know this is scary, but panic won’t fix it. We need to pressure lawmakers to fund domestic API production, support ethical suppliers in Vietnam and Mexico, and demand public inspection reports. It’s not about cutting China out overnight-it’s about building alternatives with integrity. We can do this, but it’ll take money, patience, and real accountability.

Sinéad GriffinDecember 27, 2025 AT 06:58

China’s got the money, the tech, and the will to fix this. But they won’t unless we make it profitable. Stop buying the cheapest crap. Pay more. Demand transparency. If we stop funding the bad actors, the good ones will rise. 💪💊 #QualityOverCost

jeremy carrollDecember 28, 2025 AT 03:17

it’s not all bad. some chinese plants are actually top tier. the problem is we don’t know which ones. we need a public database-like a ‘trust score’ for api suppliers-so pharmacists and patients can see who’s clean. no more guessing. just facts.

Daniel ThompsonDecember 29, 2025 AT 00:03

After reading this, I looked up my prescription. It’s sourced from Huahai. I’m going to contact my doctor and demand a switch to an EU-sourced alternative. If I’m paying out of pocket, I’m not risking my health for a $10 savings. This isn’t paranoia-it’s due diligence. And if you’re not doing the same, you’re being reckless.